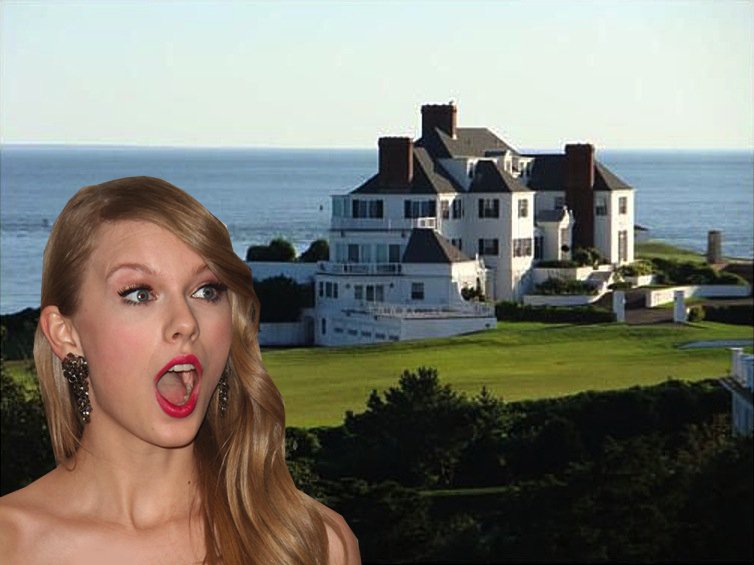

When Good Intentions Collide with Reality: The Taylor Swift Tax and the Law of Unintended Consequences

Every policymaker wants to do the right thing. But sometimes, even well-intentioned laws create outcomes no one planned for or wanted. Rhode Island’s so-called “Taylor Swift Tax” is quickly becoming a textbook example.

GoLocalProv published a story this week detailing concerns from Rhode Island realtors who say the new luxury home tax, intended to target high-end celebrity purchases, is already chilling the housing market. Not in theory. Not someday. Right now.

The GoLocalProv story can be read here.

The goal of the tax may have been fairness or revenue, but will it achieve the intended results?

Sellers are hesitant. Buyers are spooked. Deals are slowing, and the market, already strained from years of high costs and low inventory, is reacting in ways lawmakers didn’t anticipate.

That’s the law of unintended consequences.

A good idea on paper doesn’t always Translate to the real-world

On Smith Hill, it’s easy to assume people will behave a certain way, but markets don’t work like spreadsheets. They respond to incentives, uncertainty, and risk.

Raise the cost of a transaction or make future costs unpredictable and people pause, and when they pause, the whole system slows down. (Tariffs anyone?)

This is especially dangerous in a state like ours, where:

housing prices are already out of reach for many families,

construction costs remain sky-high, and

we need more movement in the market, not less.

We don’t need celebrity-inspired legislation. we need policy that actually works

The truth is, Rhode Island’s housing crisis won’t be solved by headline-grabbing taxes.

It will be solved by:

encouraging more housing supply,

lowering the cost of building and owning a home here, and

creating a stable, predictable policy environment that doesn’t scare off investment.

As someone who has spent more than 30 years running businesses, managing teams, and navigating economic ups and downs in this state, I’ve learned one thing: uncertainty is the enemy of growth.

When we make policy based on anecdotes or outrage instead of data and impact, we end up with results that are opposite of what we intended.

Rhode Island deserves better

If we’re serious about affordability and economic competitiveness, then we need to start asking a simple but powerful question every time a bill is introduced:

“What are the unintended consequences?”

Because good intentions don’t pay mortgages. Good ideas don’t automatically create housing, and slogans don’t keep the economy moving.

Thoughtful policy does.